SA’s most trusted index manager

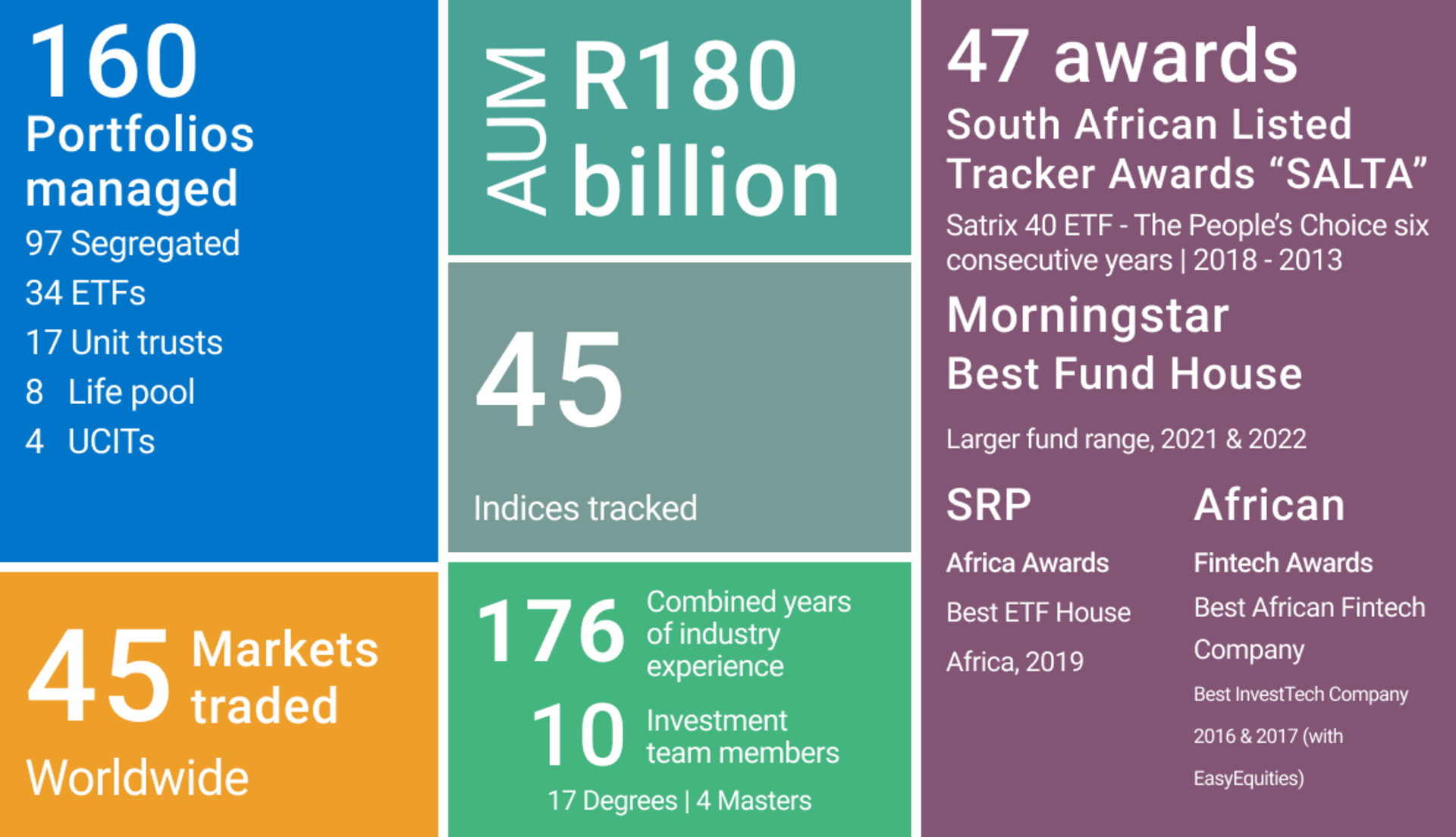

Satrix is a leading provider of index investment strategies in South Africa, with assets under management invested in our wide range of offerings. 75% of our assets under management are third-party clients, which makes Satrix the largest third-party index manager in South Africa, and the manager trusted most by clients to manage their index-based strategies. We manage index tracking and factor-based portfolios through segregated mandates, life pooled portfolios, Exchange Traded Funds (ETFs), unit trusts and Undertakings for Collective Investment In Transferable Securities (UCITS).

Key Fund Benefits

Our index-tracking system has been developed in-house to ensure we are able to customise and enhance it to suit our diverse client needs. We are able to implement trades in a transparent, cost-effective and risk-controlled way. The scalability offered is crucial in an index tracking business where operational efficiency is to the benefit of our clients.

We track industry recognised benchmarks

Low cost exposure to all the major local and international asset classes

Improved diversification, transparency, simplicity, capacity, predictability of returns, and importantly, lower fees

Fees

Fund overview

Innovation is at the core of everything that we do, and we continue to develop products for clients, relying on focused research and years of experience from a very stable team. We have proven expertise in risk management, portfolio analysis and index construction.